Wealthify Ai

A program designed to help new and practiced investor have more personalized investment exploration and planning experience.

I was able to participate in a hackathon with a group of data-analyst, software engineers and product manager. We are given only 10 days and a chosen prompt given at the start of said 10 days, and develop a solution to the prompt given for the project.

Year

2023-2024

Client

Chegg Skills

Services

Secondary and Market Research, Wireframing and Prototyping, User Flows, Information Technology, Usability Testing, and Presentation Design

-

WealthifyAi gives the users the option to develop unique plans by answering a few questions to narrow down the advice the AI Advisor within the website/application can give them. The user can have multiple plans saved within the application and can refer back to them within the plans section, as well as view its performance over varying time frames depending on how long the plan has been in existence. The program also offers ways the user can further their education and knowledge of both investment terminology, strategies, and links to educational videos over other investment topics they might want to explore.

-

Over our first meeting, we wanted to establish our scope for the next 10 days, as well as availability for the group. Everyone on the group had a day-job on top of participating, so we wanted to balance out everyone's workload and schedules to see how we can plan out our game plan.

-

Empower users to explore a wide variety of investment strategies through simulation and guided learning.

Provide AI-generated insights and personalized recommendations based on user profiles and goals.

Enhance financial literacy through interactive tools and real-time feedback.

Foster user trust through transparency, data privacy, and clear explanations of AI decisions.

First Steps

Research to establish scope of each feature that was presented to me every quarter.

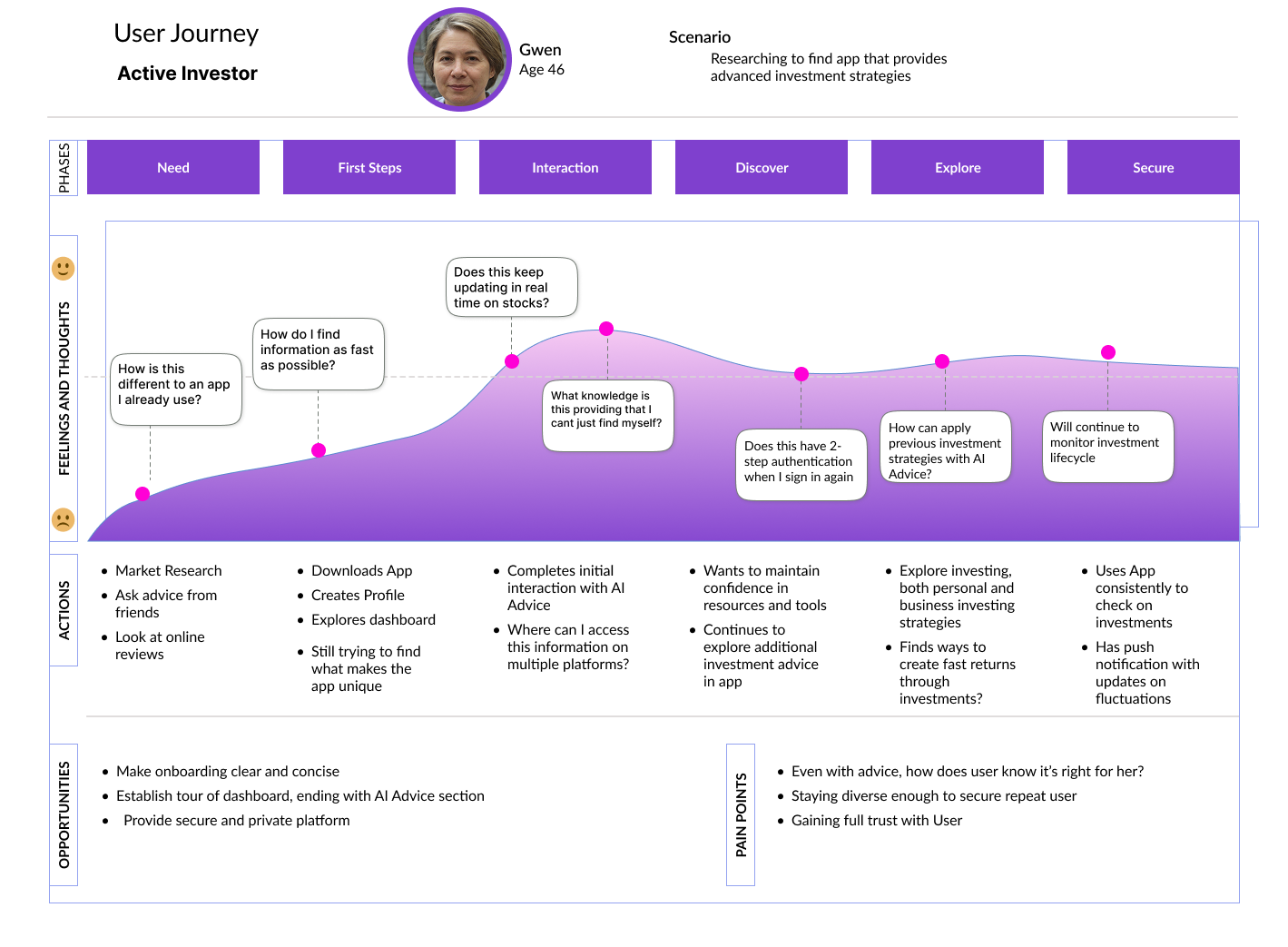

Journey mapping a sign-up flow

Competitive Analysis

Empathy Mapping

Early sketching of user flow and pages on mobile view

Flexibility

Given new and ever-changing features to focus on for the ever-evolving needs of the app.

Pivoting between the two designs, the first being more mobile forward, and the second being more desktop focused

Consistency

With an information-dense product like Wealthify AI, you need to keep the designs simple, straightforward, and easy to approach.